Rare Earth Elements

The Rare Earths Industry

What are Rare Earths?

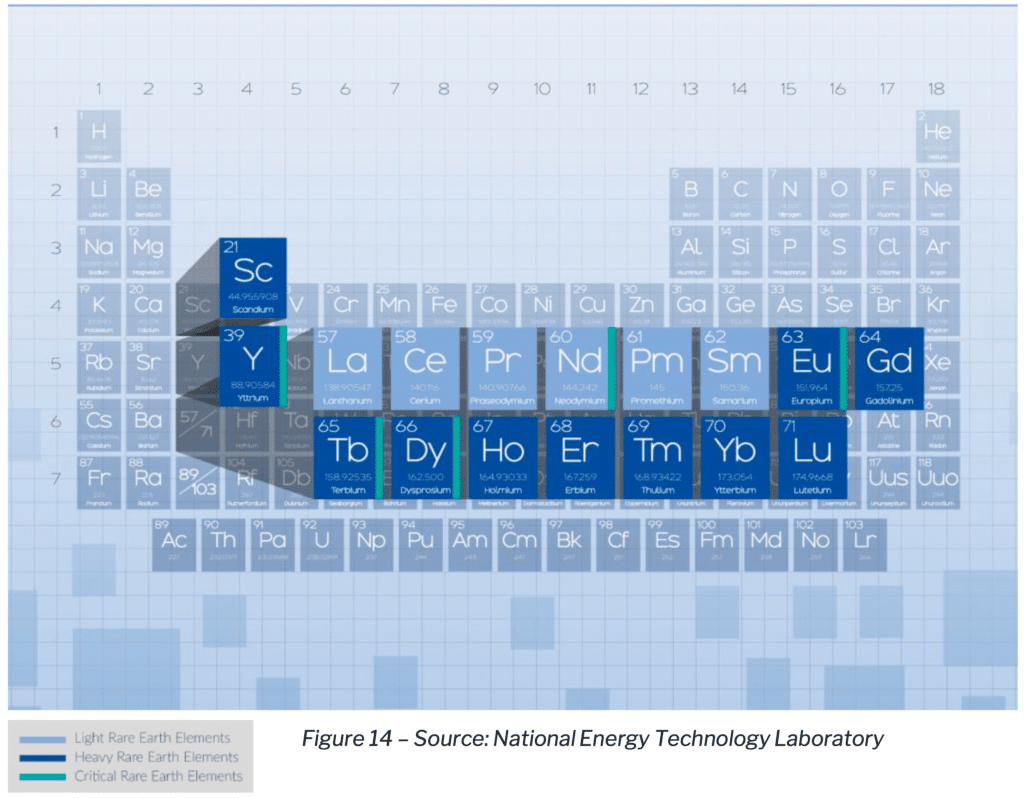

REE refers to a group 17 elements, including the 15 lanthanide elements as well as two additional elements that exhibit similar characteristics, scandium and yttrium. REEs are further divided into Heavy Rare Earth Elements (“HREEs”) and Light Rare Earth Elements (“LREEs”), generally based on their atomic weight. Rare earth deposits will include both LREEs and HREEs. REEs are found primarily in monazite and bastnasite ores, with both typically containing material concentrations of lanthanum (“Le”), Cerium (“Ce”), Praseodymium (“Pr”) and Neodymium (“Nd”).

Additionally, the U.S. Department of Energy identified 5 REEs that it considers to be “Critical Rare Earth Elements” (“CREE”), which include Neodymium, Europium, Terbium, Dysprosium, and Yttrium.

Despite their name, REEs are relatively common in the earth’s crust.

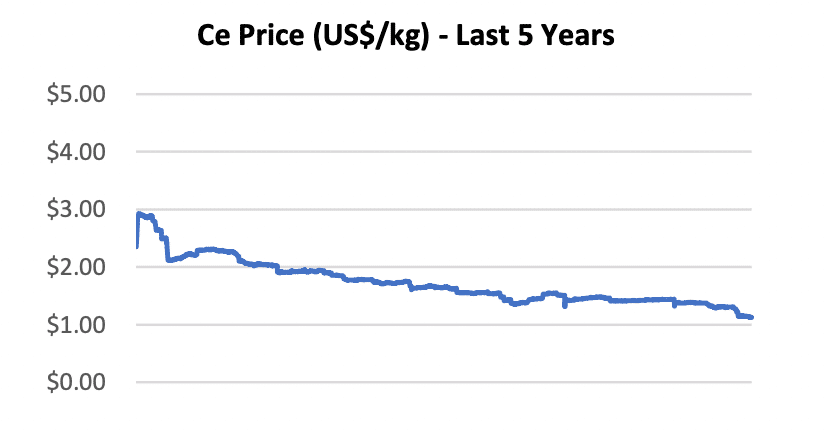

While some key REEs are in short supply, as will be discussed later in this report, others are in oversupply. For example, cerium, neodymium, lanthanum, and yttrium are all more abundant than lithium, lead, helium, silver, or gold. However, economically mineable concentrations of these elements are less common than for many other mineral commodities.

The value of a deposit is highly dependent on the relative concentrations of each REE in the deposit, and less so on the grade of Total Rare Earth Oxide (“TREO”).

Reserves and Production

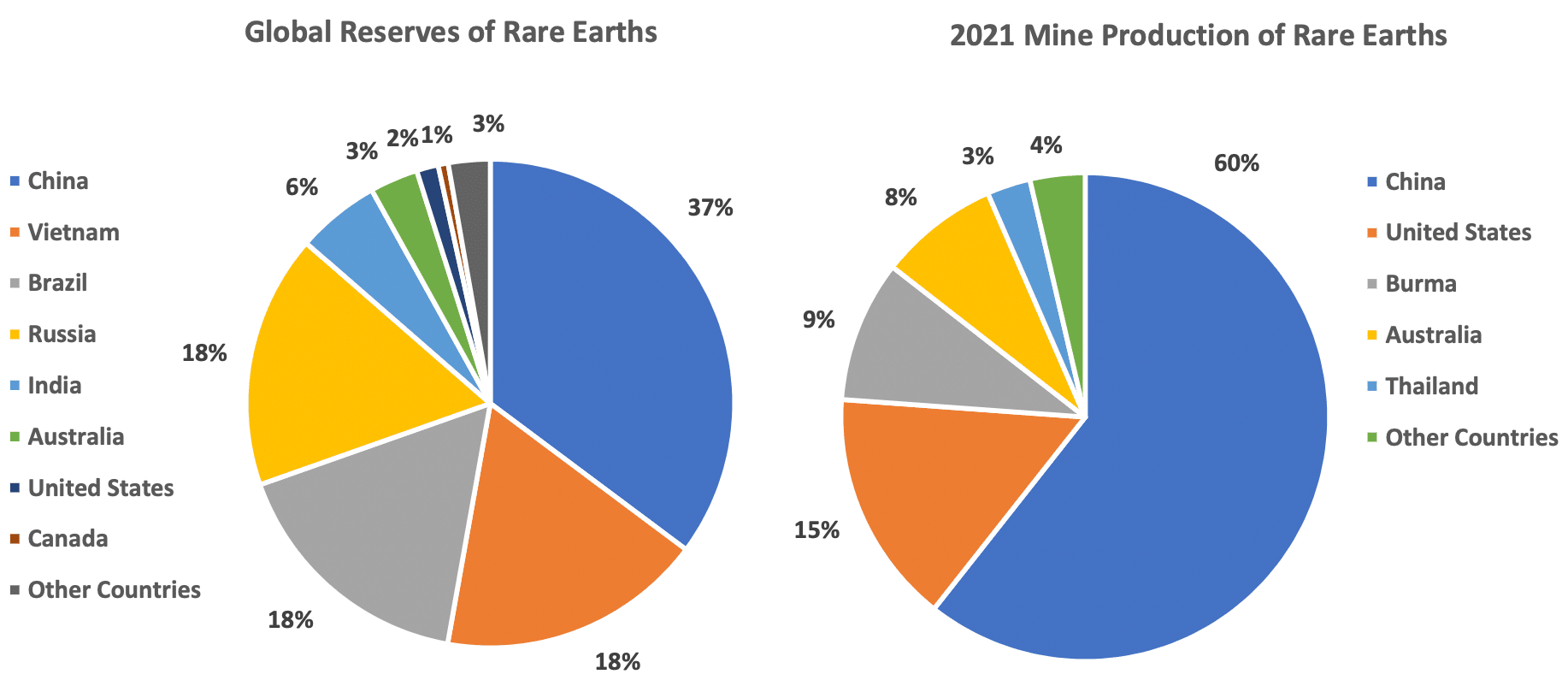

Worldwide, there are an estimated 120 million tons of REE reserves, with China containing the largest proportion of any country at approximately 37%.

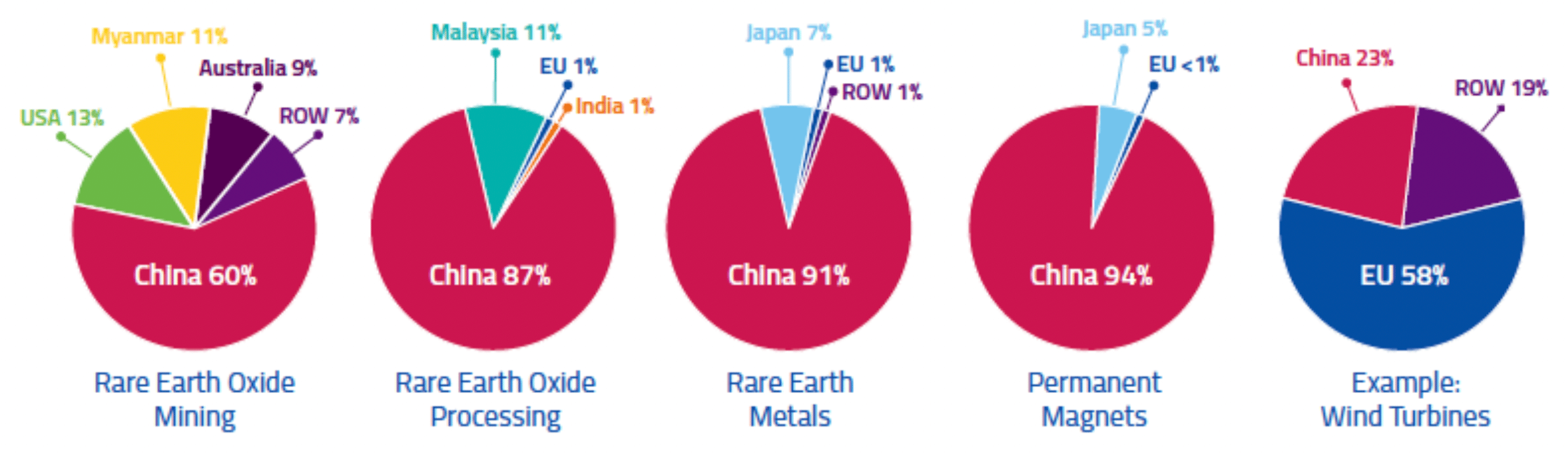

However, China represents approximately 60%7 of global production of REEs in 2021.

Furthermore, China is estimated to account for approximately 78% of REE imports to the United States.8

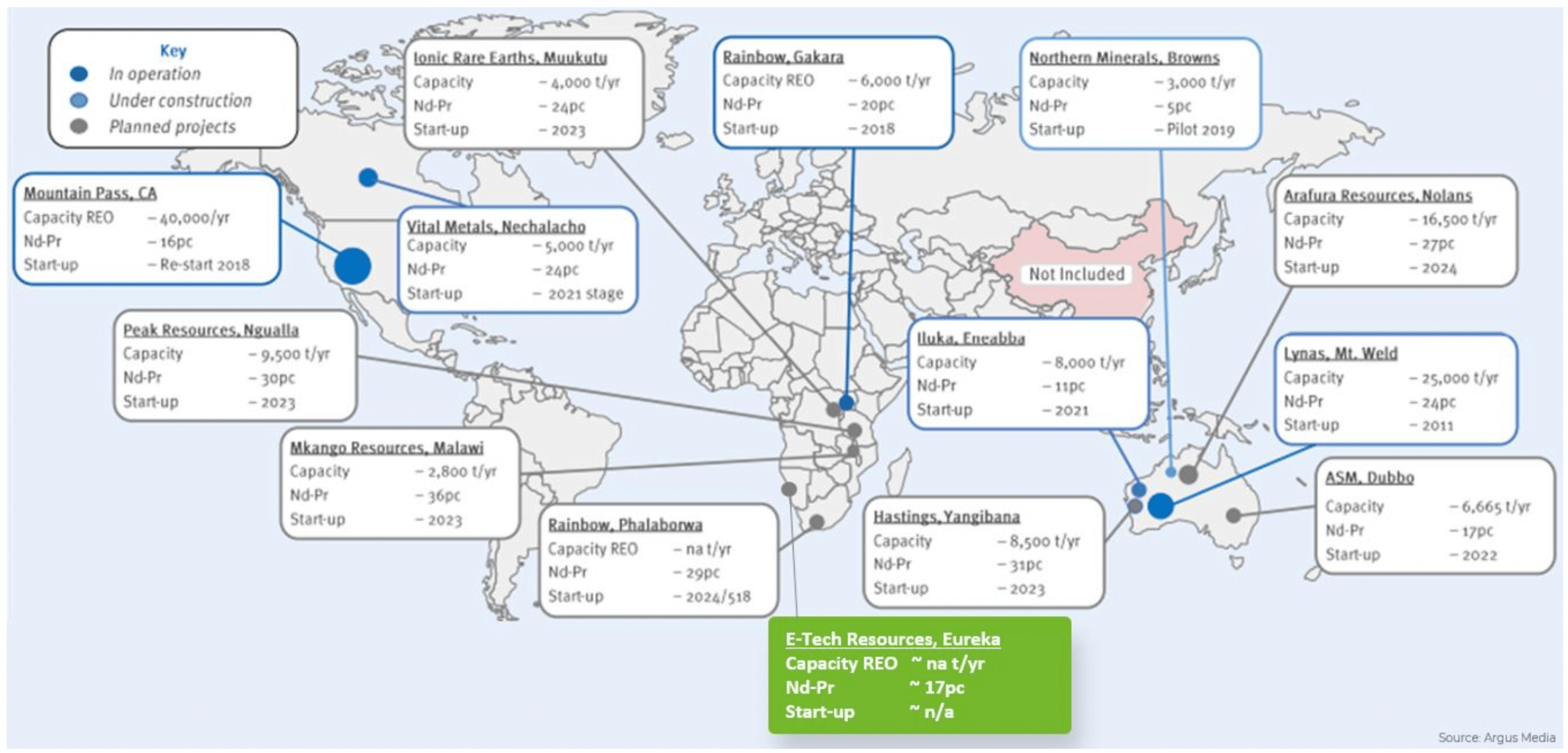

While there are a range of REE projects in development, many will face significant challenges to achieve production.

China also dominates the separation of REEs, accounting for effectively all the global supply of key REEs like Terbium and Dysprosium.

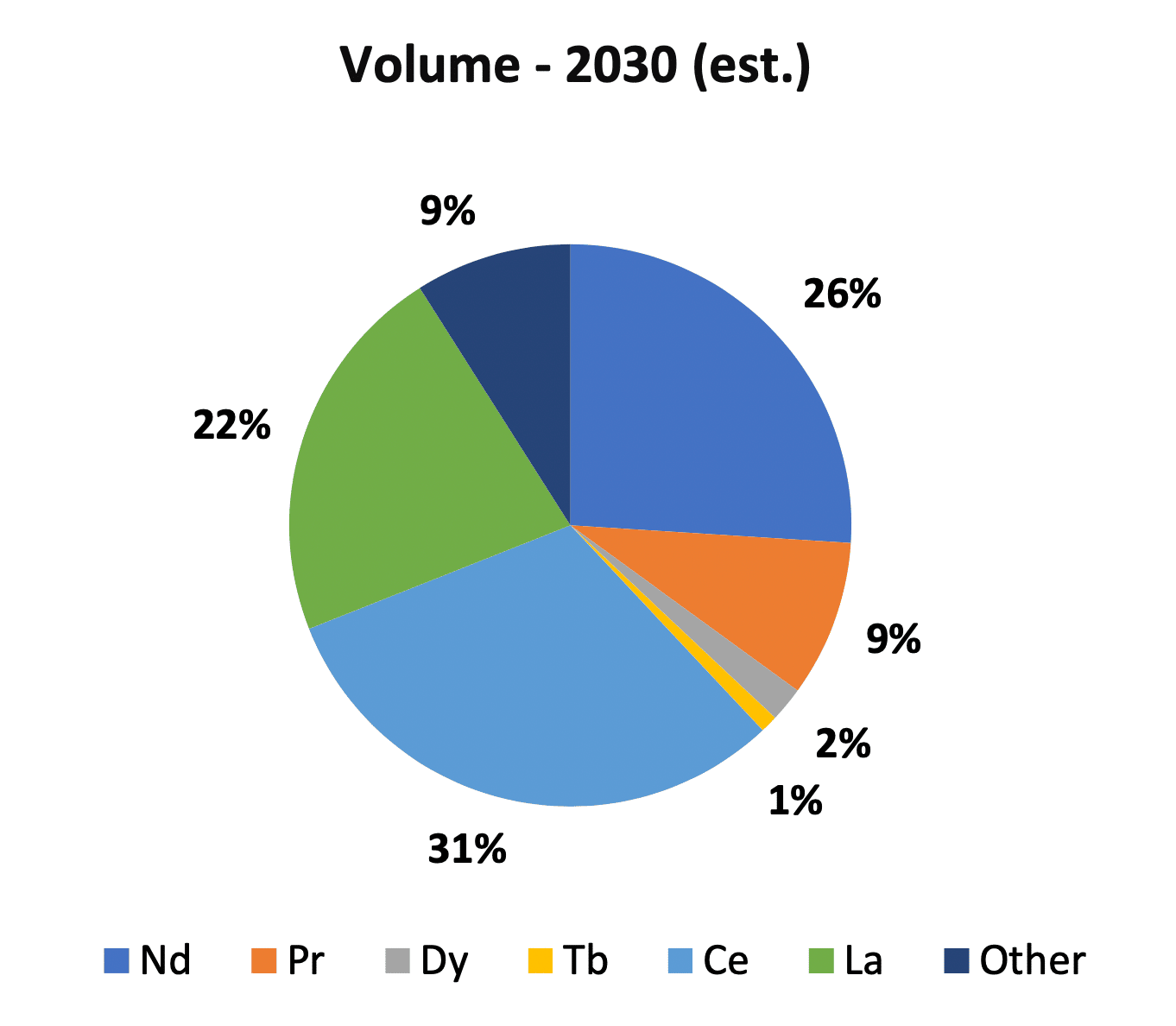

Volume vs Value

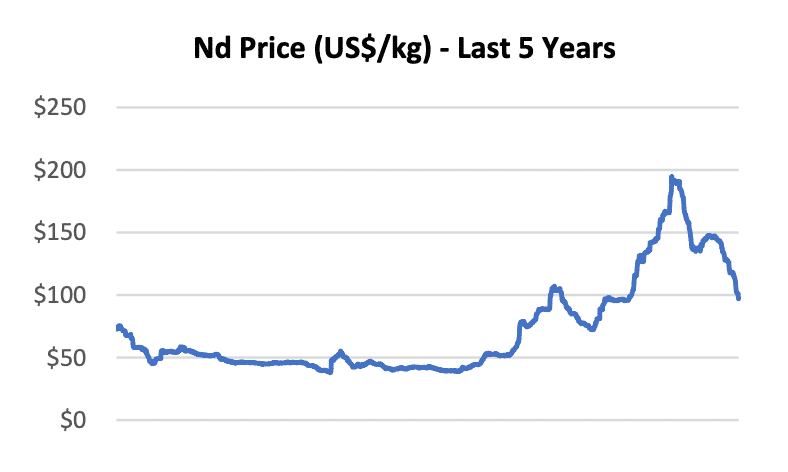

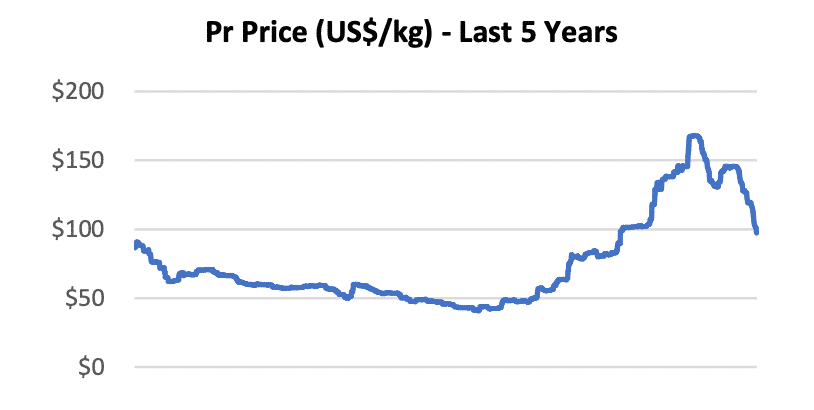

Not all REEs are equal in value. Currently, the most desirable REEs are Neodymium, Praseodymium, Dysprosium, and Terbium. Despite being expected to account for just over 1/3 of the rare earth market by volume in 2030, these 4 REEs are estimated to represent 98% of the market by value in 2030.

Supply and Demand Fundamentals

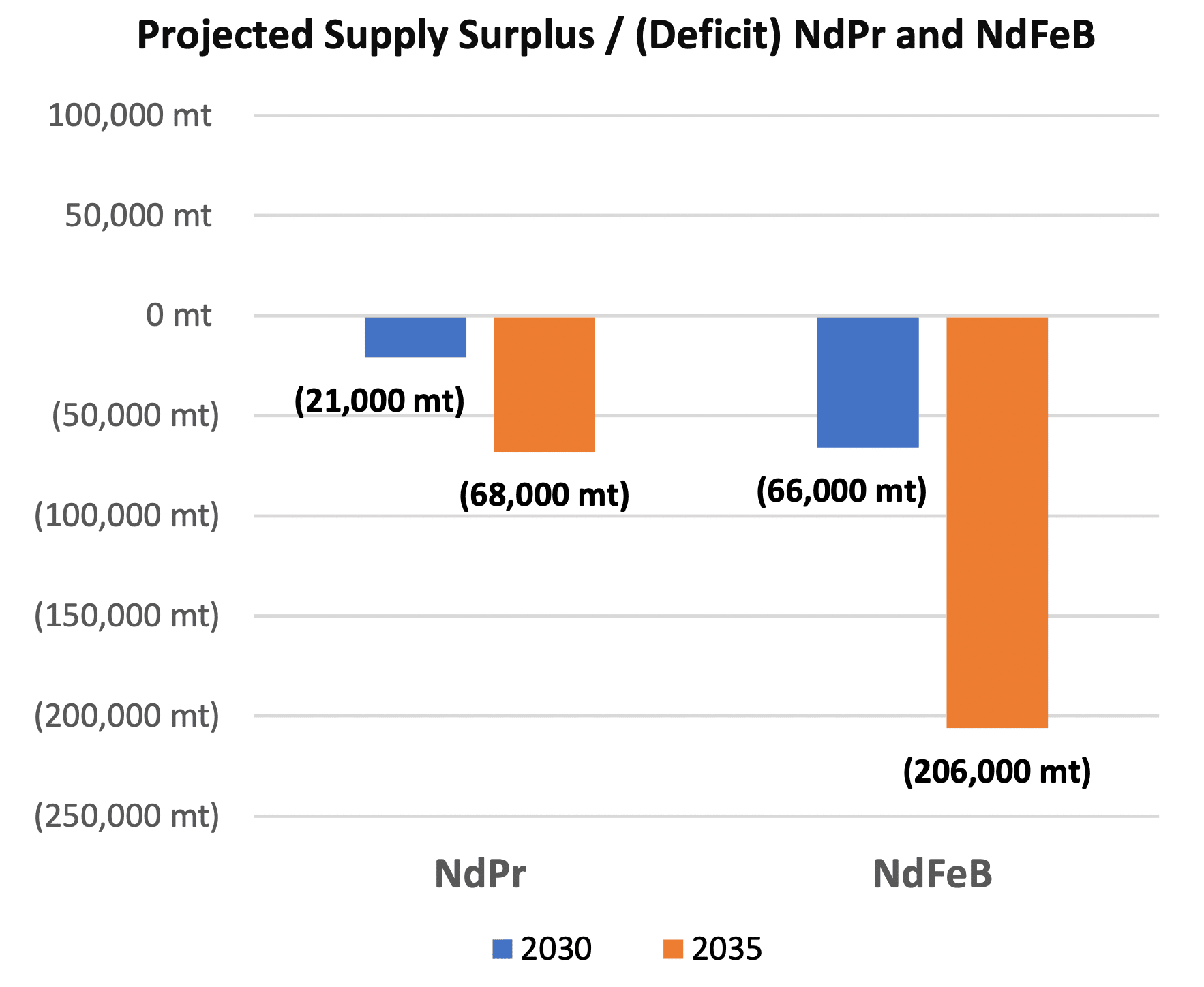

Demand for REOs, on an annual basis, doubled between 2006 – 2021, to 125,000 mt, and is projected to continue growing to 315,000 mt by 2030.9

For the reasons discussed below, including increased uses and demand for NdPr and Neodymium-Iron-Boron (“NdFeB”) magnets, there are expected to be shortages of key REEs, in particular NdPr.

While surpluses may exist in other, more abundant REEs, such as Ce and La, which are widely regarded as being in an oversupply situation.

Meeting demand for REOs with expected supply deficits will require either increasing capacity at existing operations and/or developing new rare earth mines. Both come with challenges and costs and take time to implement.

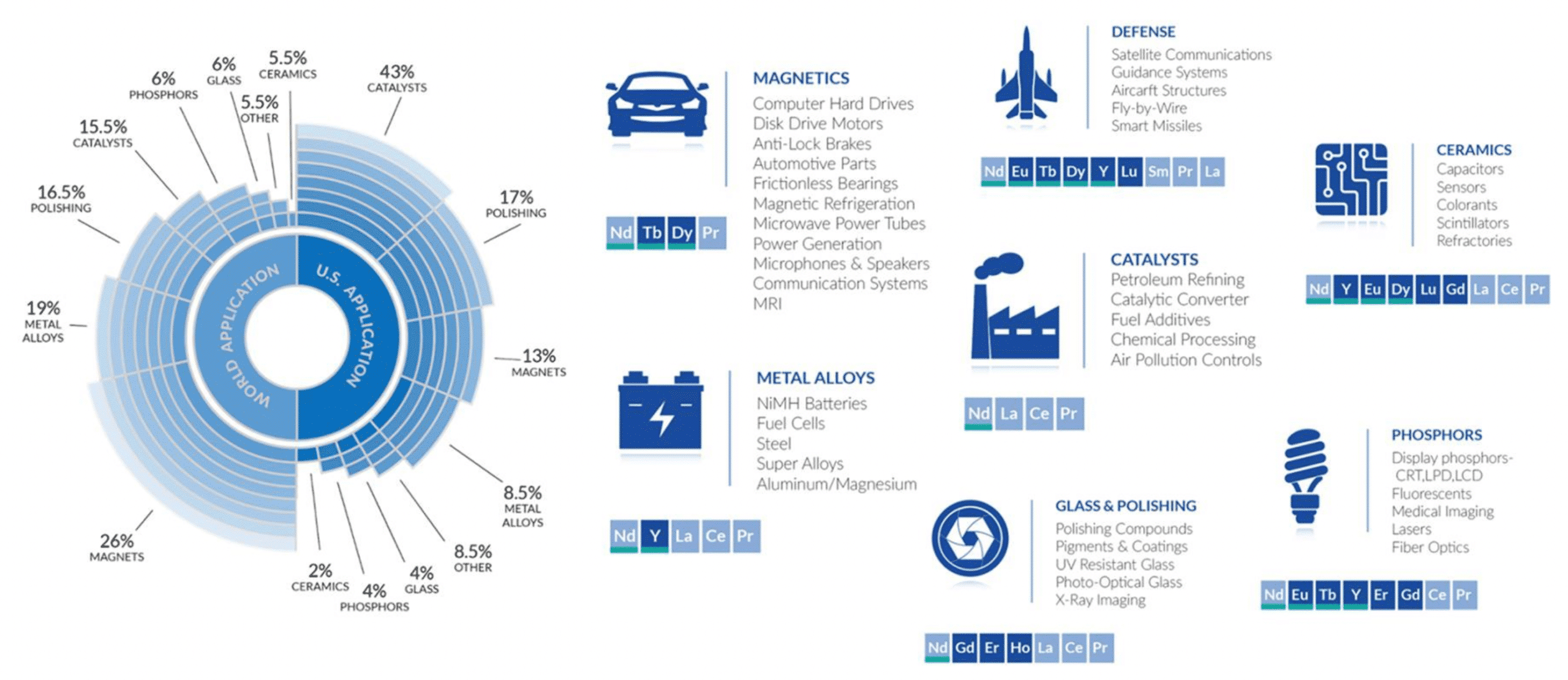

EEs are used in a wide range of applications.

Uses of REEs

As discussed above, the vast majority of value in the global rare earth market is due to Neodymium/Praseodymium, Terbium, and Dysprosium. This is due to their use in permanent magnets, which are key components in wind turbines and electric vehicle motors.

Permanent magnets are superior to other types of magnets in these applications because they maintain their magnetic properties even in magnetic fields, thereby making them critical components of electrical motors. The most widely used permanent magnet for these applications are Neodymium-Iron- Boron (“NdFeB”) magnets, which contain almost 30% rare earth content by mass.

Dy and Tb can be added to make the magnets stronger and more durable in high temperature environments (such as in an electric motor).

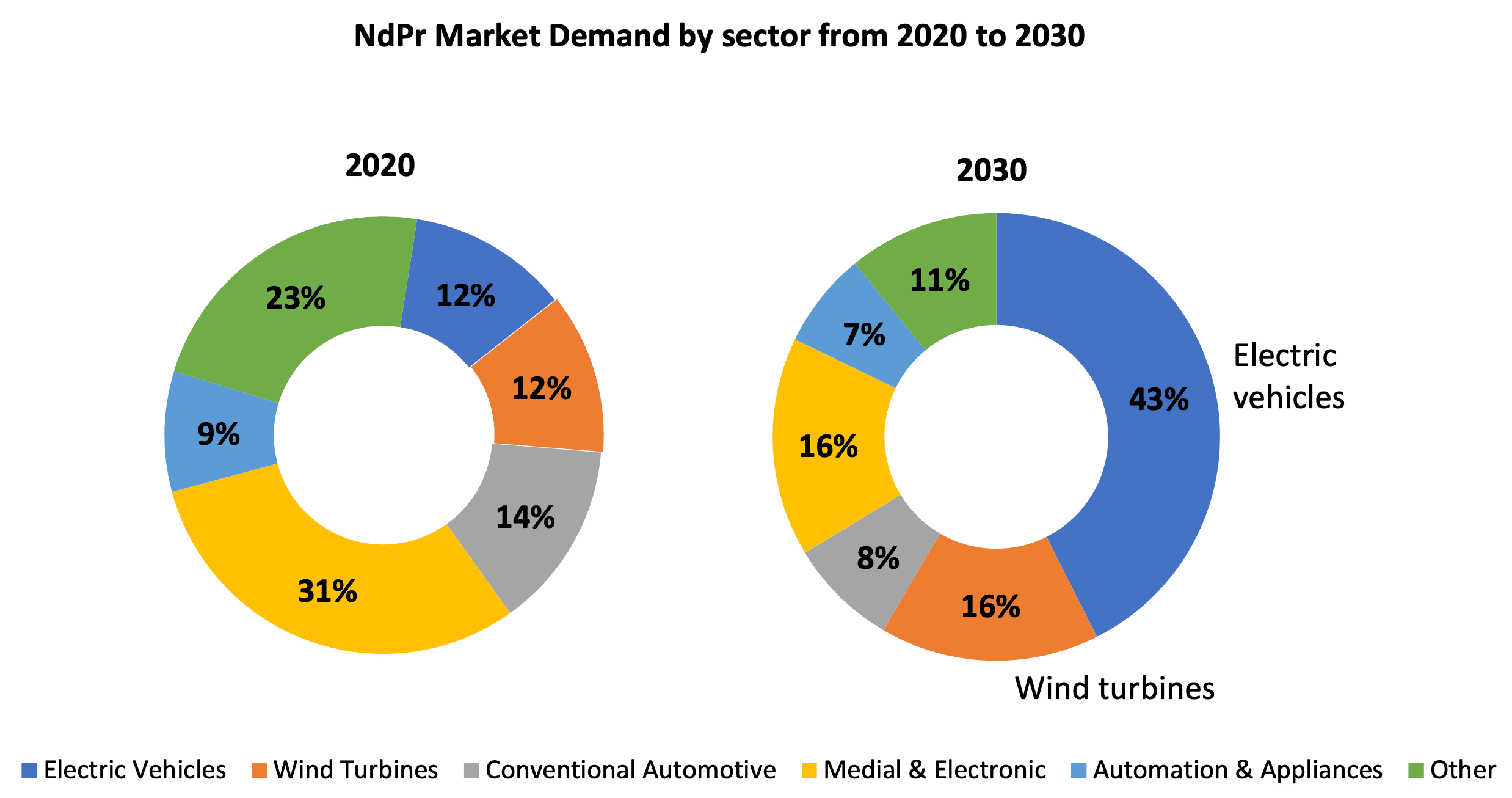

Some estimates predict the combined share of NdPr demand attributable to electric vehicles and wind turbines growing from approximately 24% in 2020 to 59% by 2030 (with electric vehicles accounting for almost 75% of that demand).

The cost of the REE and permanent magnets is significantly less than the resulting benefit. Direct-drive wind turbines, using permanent magnets, offer better yields and lower maintenance costs due to the elimination of a gearbox. This benefit is particularly critical for offshore wind turbines, where maintenance can be difficult.

Electric Vehicles

The average hybrid or electric vehicle uses between 2 – 5kg of rare earth magnets 10, equating to approximately 0.5 – 1.5kg of REEs, with some estimates of total REEs as high as 4.5 kg per hybrid or electric vehicle. This is significantly more than 0.5 – 1.0 kg of REEs estimated for a typical internal combustion engine powered vehicle. The predominant rare earth magnet in these applications is the NdFeB magnet, due to its higher magnet energy property and lower price than previous alternatives.

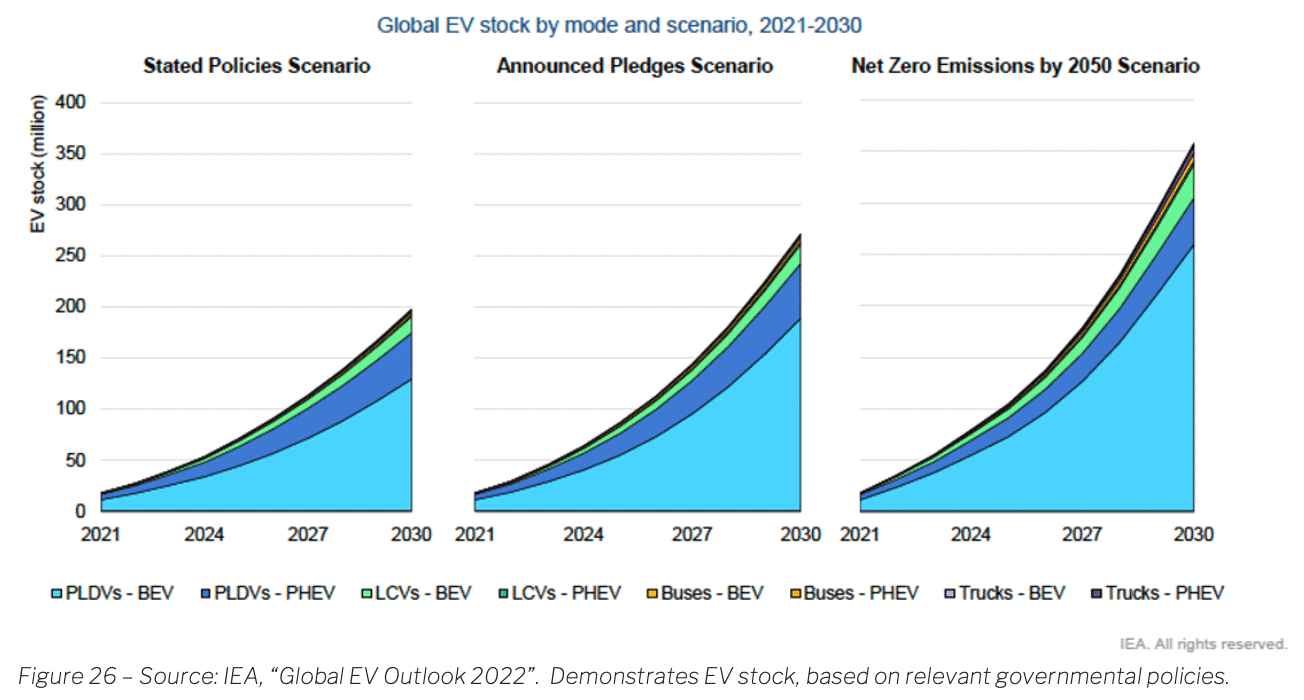

There were an estimated 16.5 million electric cars globally in 202111, but that number is expected to increase to as many as 200 – 250 million vehicles by 2030, according to estimates by the International Energy Agency (“IEA”).

This growth is largely driven by government policies to reduce overall emissions, as well as rising fuel prices and increasing consumer awareness of climate change driving shifts to “greener” alternatives. Regulatory targets set in the European Union and United States aim for an EV share of at least 50% by 2030, and there is talk of potential bans on internal combustion engines (“ICE”s).

Even more conservative estimates of 70 million EVs13 on the road by 2030 still indicate a significant annual increase from current levels and resulting demand for REEs and rare earth magnets.

Substitution risk

There is potential for other materials to be used in place of rare earth elements in a given product or application. In the case of electric vehicles, the move to induction motors may lead to a reduction in the use of rare earths, as these motors do not require the use of rare earth magnets in their construction. This could potentially reduce the demand for rare earths and create substitution risk for these materials.

Wind Turbines

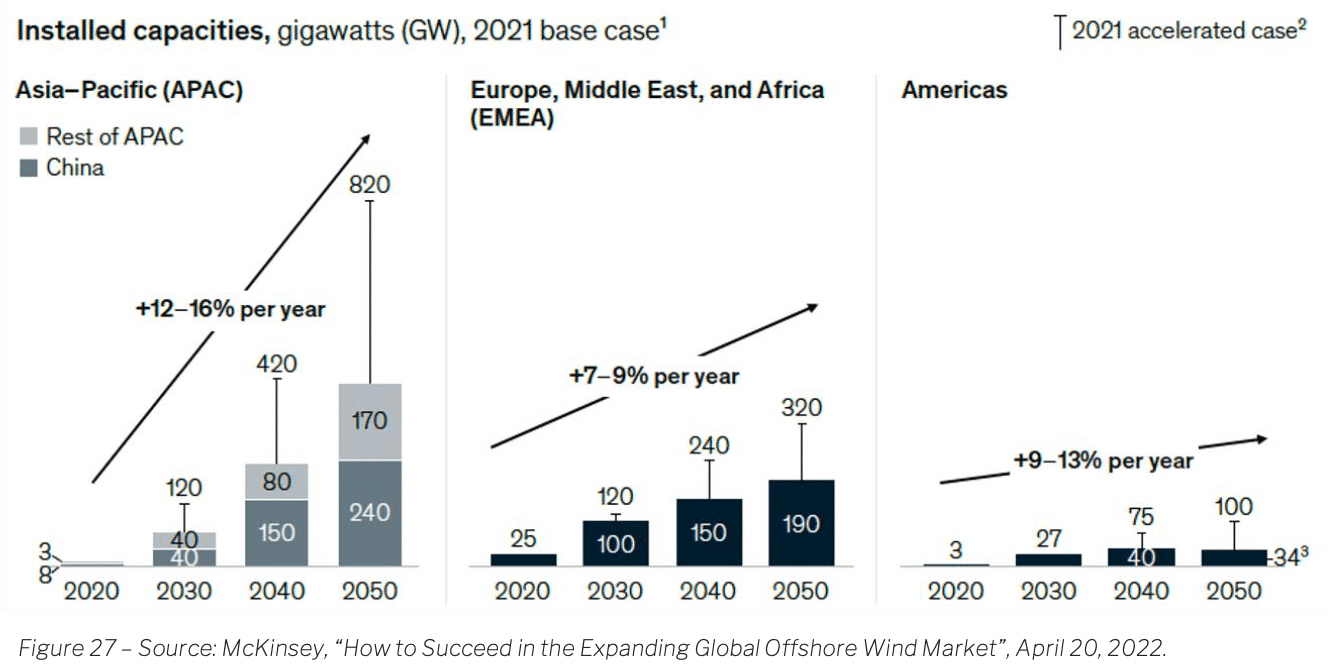

A secondary growth driver for NdPr and permanent magnets is wind turbines. Global wind power capacity is expected to grow at a CAGR of 9% between 2021 and 2030,14 reaching a projected capacity of almost 1.8 terawatts (“TW”).

Offshore wind capacity, as a subset of total wind capacity, is estimated to grow from approximately 40 gigawatts (“GW”) in 2020 to 200 – 270 GW by 2030,15 implying a CAGR of approximately 20% over that period, and up to 630GW by 2050 with further upside potential to as much as 1,000 GW.

Direct drive turbines are estimated to require 650kg of permanent magnets per MW (which, assuming 30% REEs in each magnet, equates to approximately 200kg REE per MW). This is approximately 4 – 8x the mass of permanent magnets required for a geared turbine.

Defence Applications

REEs are also used in many defense applications, including motors in critical equipment, guidance systems, and radar and sonar applications. For example, a single F35 fighter jet requires over 400kg of rare earth materials, while a Virginia-class submarine requires more than 4,000kg.16 The U.S. government aims to reduce its reliance on Chinese REEs by diversifying its sources of critical minerals.

Influence of China

China has dominated the REE industry since the 1980’s. Prior to that, since the 1960s, the U.S. was the world’s largest producer of REEs. By the 2010s, China produced 85% of global REEs and supplied 95% of processed REEs. Currently, 37% of global REE reserves are in China, however China represents 60% of global REE mine production (as of 2021).

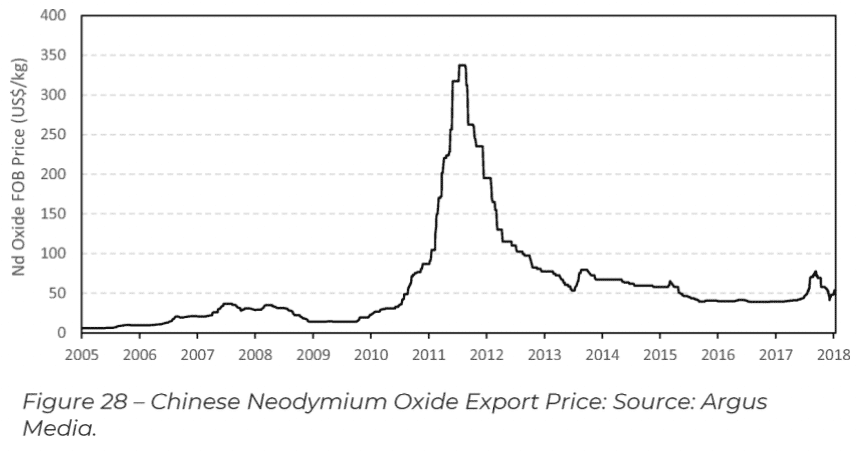

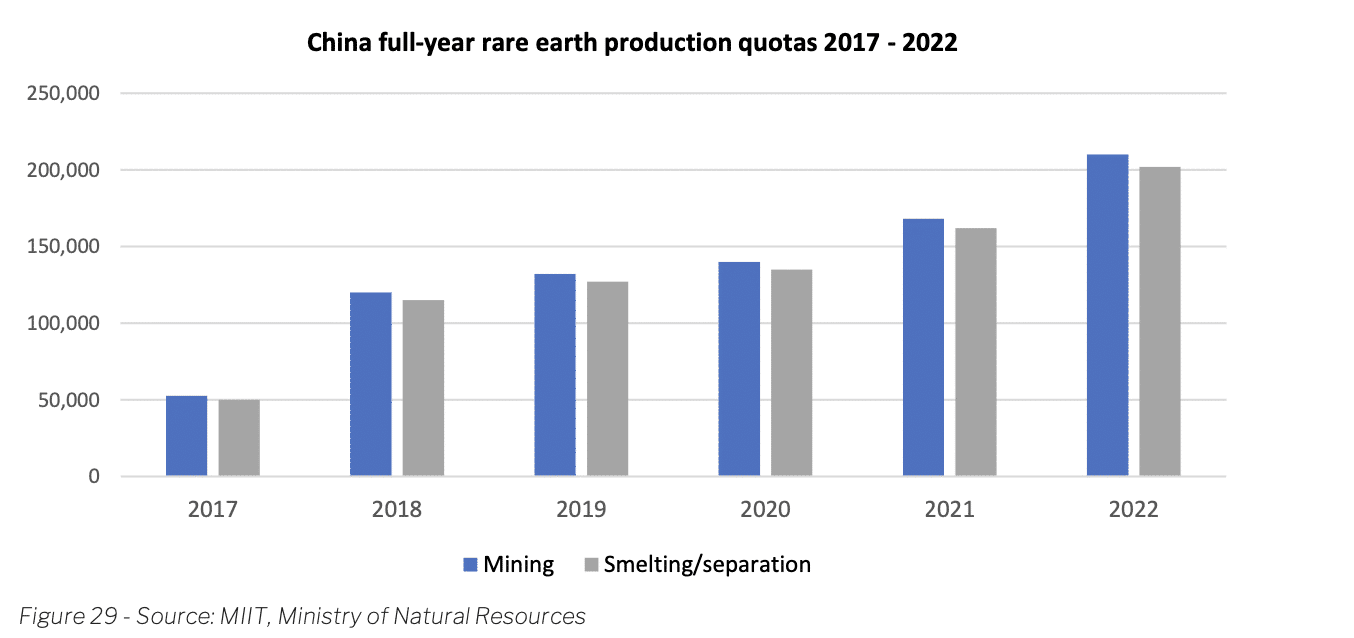

China’s market dominance has led to a period of pricing and supply uncertainty. Quotas exist, set by the Chinese government, controlling rare earth production in and exports from China.

A significant reduction in those quotas in 2010, 25% for production of REOs and 37% for export of various RE products, resulted in significant price increases in 2010 – 2011.17

(TSXV: REE | FSE: K2i)

January 2023

Quotas have since increased but remain a significant supply concern.

Quotas for H1-2022 were increased by 20%, relative to H1-2021, for both rare earth mining and processing. Mining quotas increased from 84,000 tons to 100,800 tons and smelting and separation quotas increased from 81,000 tons to 97,200 tons.

As a result of the price volatility of REEs, and general recognition of the importance of access to critical REEs ex-China, many countries have indicated a desire to develop additional or domestic sources for critical elements. As a result, China is working to maintain their control of the market through purchase agreements, control over REE processing and separation, and manufacture of downstream products.

Major Players in the REE Mining Industry

The major players in the Chinese rare earths mining and processing markets have been China Northern Rare Earth, China Southern Rare Earth (a subsidiary of Ganzhou Rare Earth Group), Chinalco Rare Earth & Metals Company (a subsidiary of Aluminum Corporation of China or Chinalco), Xiamen Tungsten, Guangdong Rare Earth Industry Group, and China Minmetals Corporation.

Offshore wind capacity, as a subset of total wind capacity, is estimated to grow from approximately 40 gigawatts (“GW”) in 2020 to 200 – 270 GW by 2030,15 implying a CAGR of approximately 20% over that period, and up to 630GW by 2050 with further upside potential to as much as 1,000 GW.

Direct drive turbines are estimated to require 650kg of permanent magnets per MW (which, assuming 30% REEs in each magnet, equates to approximately 200kg REE per MW). This is approximately 4 – 8x the mass of permanent magnets required for a geared turbine.

In late 2021, it was announced that the Chinese rare earth industry would consolidate, with Chinalco Rare Earth & Metals Co, Minmetals Rare Earth (a subsidiary of China Minmetals), and China Southern Rare Earth Group, as well as two research companies, combining into the newly established China Rare Earth Group Co. Ltd. Ownership of the new entity is 31.21% to the State-owned Assets Supervision and Administration Commission (the national asset regulator) 20.33% to each of Aluminum Corporation of China, China Minmetals, and Ganzhou Rare Earth Group, with the remainder split between the two research companies, China Iron & Steel Research Institute Group and Grinm Group Corporation Ltd.

Outside of China, there are a wide range of planned projects, but few current producers.

The two largest producers outside of China are Lynas and MP Materials.

Lynas

Lynas operates the Mount Weld rare earth mine in Western Australia. Rare earth concentrates are processed at Lynas’ plant in Malaysia, which is the world’s largest single rare earths processing plant. Lynas is currently constructing an additional rare earths processing facility in Kalgoorlie, Australia and proposing an additional processing facility in the United States.

The Mt Weld deposit reported total ore reserves of 18.9 million tonnes at a TREO grade of 8.3%.

In their FY2022, Lynas produced 15,970 tonnes of REO including 5,880 tonnes of NdPr.

MP Materials

MP Materials owns and operates the Mountain Pass rare earths mine in California. The Mountain Pass mine has been in production off and on since 1952. MP Materials has a stated goal of restoring the “full rare earth supply chain to the United States”.

Over the last 12 months (through June 2022), MP Materials produced 43,387 metric tons of REO in concentrate. By the end of 2023, they expect to achieve a run-rate annual production of 20,000 metric tons of refined TREO, including ~6,075 metric tons of NdPr.

In 2022, MP Materials plans to start processing rare earths at its own facility, whereas it previously shipped rare earth concentrate to China for processing. Once their facility upgrades are complete, MP Materials will be able to produce separated REOs from its concentrate. Longer-term plans include expanding downstream into magnet production.

In their September 2021 technical report, Mountain Pass was reported to have ore reserves of 30.45m st (short tons) at a TREO grade of 6.36%.24

Investor Information

Book an investor call

Our Forward-Looking Statement

Certain information set forth in this website contains “forward-looking information”, including “future-oriented financial information” and “financial outlook”, under applicable securities laws.